- KEY TAKEAWAYS:

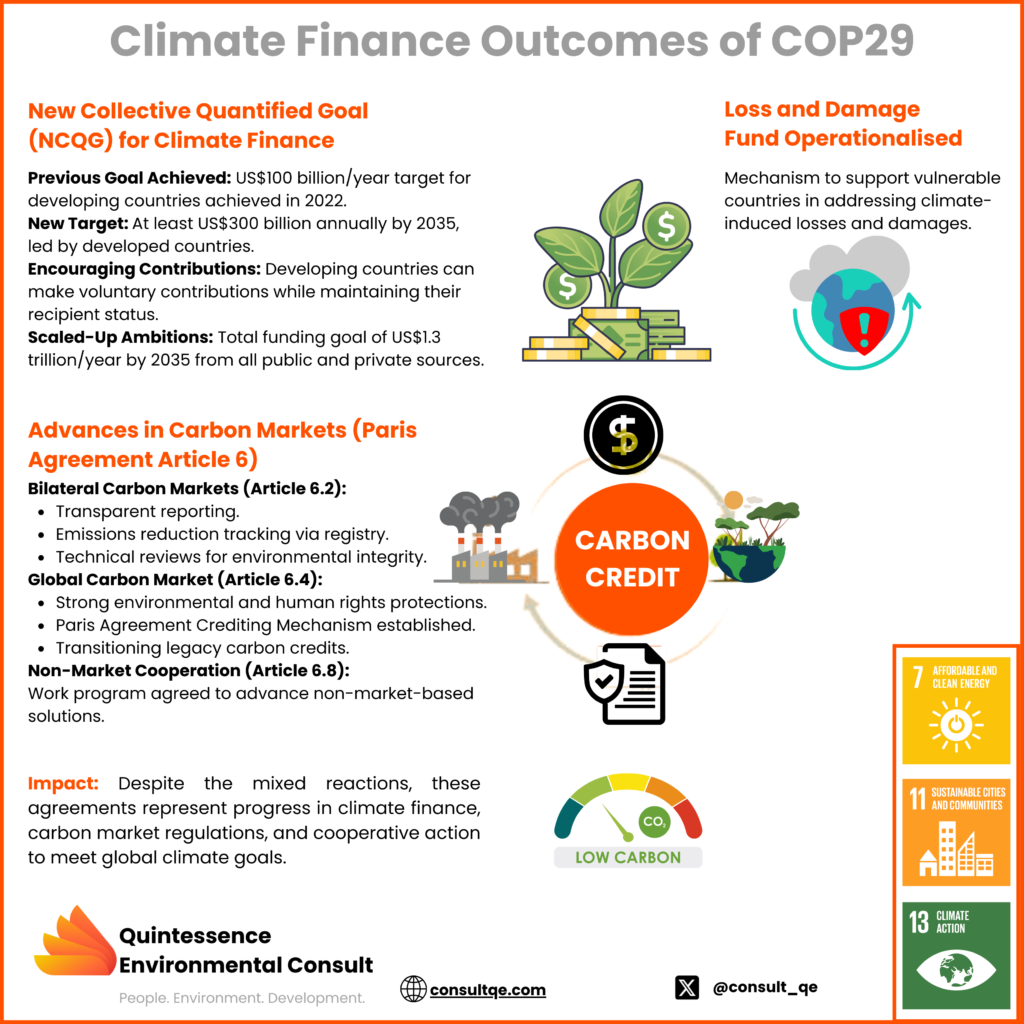

- COP29 set new, ambitious financial goals, including tripling the annual climate finance commitment for developing countries to $300 billion and aiming to mobilize $1.3 trillion annually by 2035.

- The Loss and Damage Fund, established during COP27, was further operationalized at COP29. This fund aims to assist vulnerable countries in dealing with climate-related disasters.

- COP29 made progress in refining international carbon market rules to enhance environmental integrity and prevent double-counting, which is vital for global carbon trading and emission reductions.

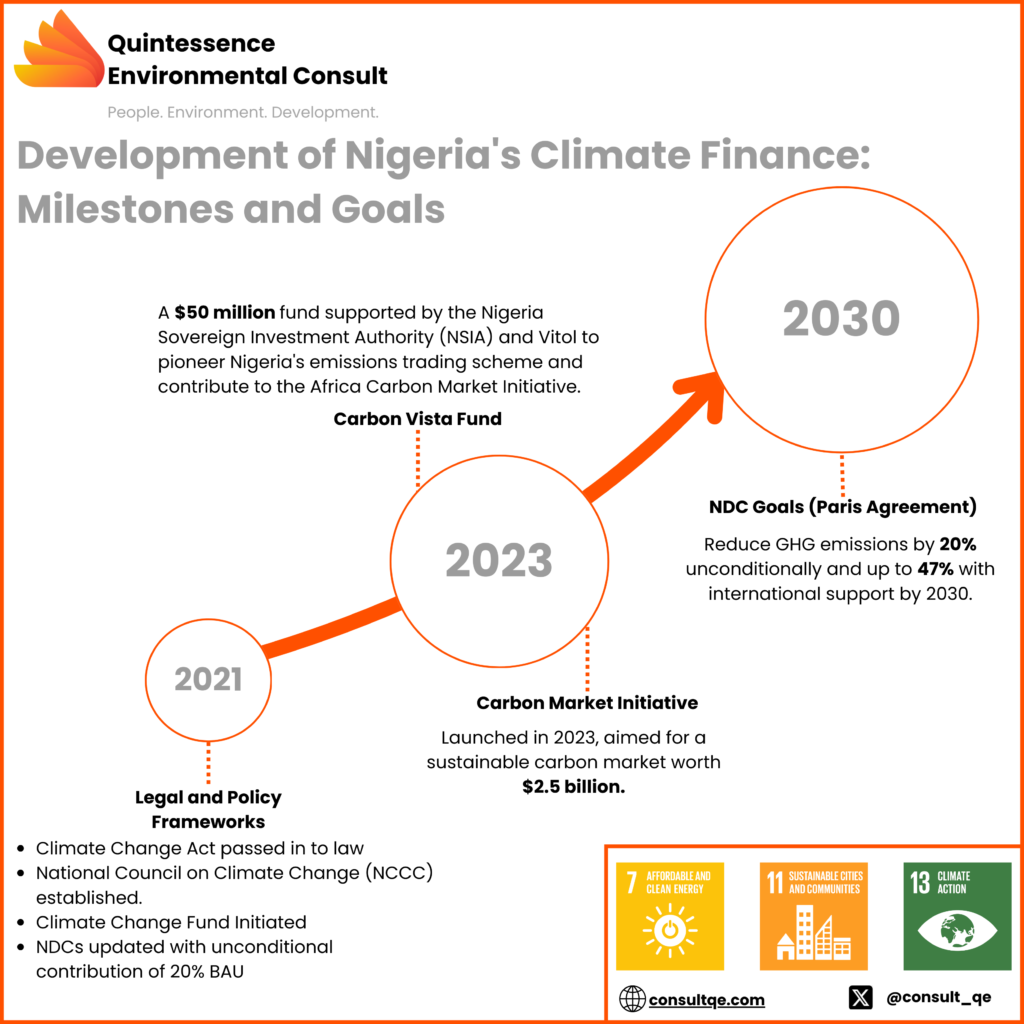

- Nigeria has made strides in climate finance through the 2021 Climate Change Act and initiatives such as the $50 million Carbon Vista fund. The country launched a carbon market initiative targeting a $2.5 billion market and continues to focus on renewable energy, transportation, agriculture, and forest conservation under its Nationally Determined Contributions (NDCs).

- Key challenges for Nigeria include strengthening the Climate Change Act, mobilizing public funds for the Climate Change Fund, enhancing regulatory frameworks for carbon markets, and raising public awareness of climate finance benefits. Establishing a centralized carbon registry and improving collaboration between federal and sub-national governments are crucial next steps.

2. CLIMATE CHANGE

Climate change is now the hottest topic in Nigeria, making waves across radio stations, television, and social media. Meanwhile, the impacts of climate change have been felt for over a decade in Nigeria. These impacts and consequences have been observed in extreme weather events, land degradation, conflicts, and increasing food insecurity. But why the sudden hype and interest? Look no further than climate finance!

3. WHAT IS CLIMATE FINANCE?

According to the United Nations Framework Convention on Climate Change (UNFCCC), climate finance refers to local, national, or transnational financing—drawn from public, private, and alternative sources of financing—that seeks to support mitigation and adaptation actions that will address climate change.

Climate finance provides a framework for setting up and dispensing financial resources and instruments to foster climate action, particularly to support investments required to transition to a low-carbon economy, especially for developing countries. It should be noted that climate financing instruments can be in the form of grants and donations, green bonds, equities, debt swaps, guarantees, and concessional loans, which can be employed for different activities including mitigation, adaptation, and resilience building.

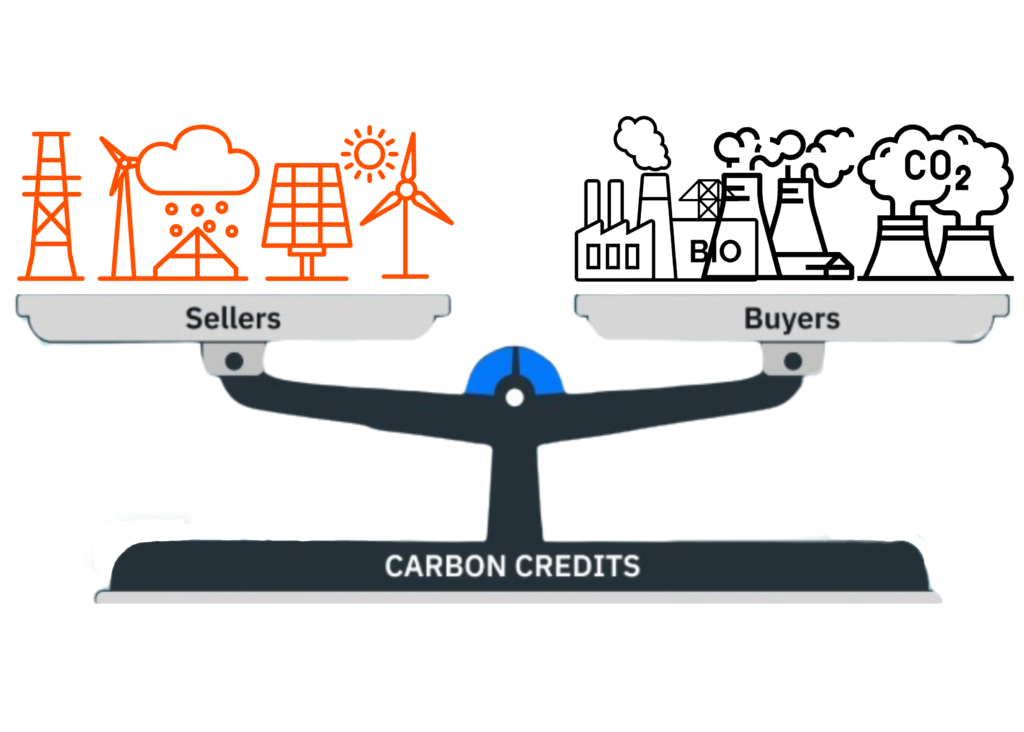

It is noteworthy to highlight carbon emissions trading, which is a crucial component of the carbon finance mechanism. Emissions trading is an innovative market-based system that allows entities to trade in carbon credits, which aims to encourage the reduction of greenhouse gas (GHG) emissions globally. Its operational framework can vary from region to region or even state to state, based on local regulations and policies. Overall, it is a versatile mechanism that derives funding for climate action, especially in developing economies.

It is important to mention that Nigeria’s Climate Change Act, established in 2021, birthed the Nigeria Climate Change Council (NCCC), which leads climate change policy and action in Nigeria. The Nigeria Climate Change Act also established a climate change fund that will derive funding from multilateral sources, including climate finance instruments as defined above. Accordingly, it is reasonable to ask, how far has the NCCC fared since 2021, and what progress has been made in establishing the climate change fund?

4. HISTORICAL DEVELOPMENT AND INTERNATIONAL REGULATORY FRAMEWORK FOR CLIMATE FINANCE

The historical development of climate finance can be traced back to the United Nations Framework Convention on Climate Change (UNFCCC) in 1992. This landmark agreement established the principle of “common but differentiated responsibilities,” recognizing that developed countries, with their historical emissions, should take the lead in addressing climate change. This included providing financial and technological support to developing countries.

In 1997, the outcome of the Kyoto Protocol further elaborated on the commitment of developed countries to reduce their greenhouse gas emissions and provide financial resources to developing countries. It established the Clean Development Mechanism (CDM), allowing developed countries to invest in emission reduction projects in developing countries.

However, it was not until 2015 that significant progress was made through the Paris Agreement. The Paris Agreement marked a significant turning point, with all countries committing to reduce their emissions and strengthen climate resilience. It also reaffirmed the commitment of developed countries to mobilize $100 billion per year by 2020 to support climate action in developing countries.

5. CLIMATE FINANCE POST-PARIS AGREEMENT

Since then, efforts have focused on scaling up climate finance, diversifying funding sources, and improving the effectiveness of climate finance flows. The Organisation for Economic Co-operation and Development (OECD)’s seventh assessment of progress towards the UNFCCC goal finds that in 2022, developed countries provided and mobilized a total of USD 115.9 billion in climate finance for developing countries, exceeding the annual USD 100 billion goal for the first time. This achievement occurred two years later than the original 2020 target year, but one year earlier than projections produced by the OECD prior to COP26.

Some multilateral funds that developing countries can access include the Green Climate Fund (GCF), the Global Environment Facility (GEF), and the Adaptation Fund (AF). These funds were established over the years as financial instruments of the United Nations Framework Convention on Climate Change (UNFCCC) to provide resources to developing countries. The UNFCCC maintains a finance data portal, which is very helpful in presenting data and information about financial flows and projects in developing countries.

There are several other funding sources and types, including private sector engagements, due to the increasing role of private finance in sustainable investments, which are facilitated by green bonds, impact investing, and climate-related financial disclosures. The World Bank’s International Finance Corporation (IFC) has made significant progress in this domain, elucidating the operational frameworks that support access and sustainable practices that guarantee returns on investments. It is pertinent to note that the value of the global carbon market reached a record high of $949 billion in 2023, a 2% increase from the previous year. The global carbon offset/carbon credit market is expected to grow from $331.8 billion in 2022 to $1.6 trillion by 2028.

6. COP 29 AND EMERGING ISSUES ON CLIMATE FINANCE

The 29th Conference of the Parties (COP29) to the United Nations Framework Convention on Climate Change (UNFCCC) was held in Baku, Azerbaijan, from the 11th to the 22nd of November 2024. Analysts from around the world dubbed COP29 the “finance COP” due to high expectations surrounding the subject, as well as the global demand to break through limiting barriers to ambitious action by stakeholders. The UN Climate Change Conferences (COPs) take place every year and are the world’s only multilateral decision-making forum on climate change, bringing together almost every country on Earth.

Despite all the anticipation, and even going into overtime by about 35 hours, the conference ended with mixed reviews, with some observers noting that it was underwhelming. Here are some key takeaways from the conference on climate finance:

New Finance Goal: A landmark agreement was reached to triple the annual climate finance goal for developing countries from $100 billion to $300 billion by 2035. This increased funding is crucial for these nations to adapt to climate change and transition to low-carbon economies. However, the commitment still needs clarification on the specifics of who exactly is funding the money and how it will be operationalized. For example, China, being one of the current leading emitters of GHGs, is only required to make “voluntary” contributions based on its classification as a “developing” and “emerging” economy.

$1.3 Trillion Target: The agreement also set an ambitious target of mobilizing $1.3 trillion per year in climate finance by 2035, sourced from both public and private sectors. This broader goal aims to address the substantial financial needs of developing countries. Some countries, including India and Nigeria, accused the COP29 presidency of pushing the deal through without their proper consent, following chaotic last-minute negotiations.

7. OTHER KEY OUTCOMES:

Loss and Damage Fund: The operationalization of the Loss and Damage Fund, established at COP27, was a major achievement. This fund will provide financial assistance to vulnerable countries impacted by climate-related disasters.

Carbon Markets: Progress was made in refining the rules for international carbon markets, aiming to ensure environmental integrity and prevent the double-counting of emissions reductions.

Mitigation and Adaptation: While there were no major breakthroughs in terms of new mitigation commitments, the conference emphasized the urgent need for increased ambition in both mitigation and adaptation efforts.

Challenges and Criticisms:

- Limited Ambition: Some critics argue that the new finance goal, while significant, is still insufficient to address the scale of the climate crisis.

- Implementation Challenges: The successful implementation of the new finance goal and the Loss and Damage Fund will require strong international cooperation and effective governance.

- Fossil Fuel Phase-out: The conference failed to reach a consensus on a clear timeline for phasing out fossil fuels, a crucial step for limiting global warming.

Overall, COP29 made important strides in climate finance, but challenges remain in translating these commitments into tangible action and ensuring a just and equitable transition to a low-carbon future.

8. NIGERIA THUS FAR…

Nigeria’s Nationally Determined Contributions (NDCs) under the Paris Agreement set ambitious goals to unconditionally reduce GHG emissions by 20% and up to 47% with international support by 2030. The focus areas for emission reductions include renewable energy, agriculture, transportation, waste management, and forest conservation. The NDC identifies carbon credits and carbon trading as potential financing mechanisms to support emissions reduction goals, promoting projects that align with carbon credit standards and criteria. The Presidency has set up several committees to gain traction in climate finance, but these committees have not been decisive. Some of the committees include the Presidential Steering Committee on Project Evergreen, the Intergovernmental Committee on the Carbon Market Activation Plan, the Presidential Committee on Climate Action and Green Economic Solutions, and the Steering Committee to Review Business Plans and Guideline Documents for the Climate Change Fund.

To foster opportunities in climate finance, the Nigerian carbon market initiative was launched last year by the President of Nigeria, Mr. Bola Ahmed Tinubu. The initiative aims to develop a sustainable carbon market worth $2.5 billion. It will also advance the regulatory frameworks for compliance carbon markets (CCM) and voluntary carbon markets (VCM) in Nigeria. These efforts are still in the pipeline to be unveiled in 2025.

Enter the National Sovereign Investment Authority (NSIA), which has made significant strides through a couple of engagements. One such effort is the $50 million Carbon Vista fund, a joint venture supported by the NSIA and Vitol (a Swiss-based, Dutch multinational energy and commodity trading company). According to the NSIA, Carbon Vista is expected to serve as a catalyst in the creation of the domestic emissions trading scheme, a pioneer in the Africa Carbon Market Initiative (ACMI), and to create a pipeline of high-quality credits for the global voluntary carbon markets.

9. NEXT STEPS FOR NIGERIA

In light of the progress made and emerging global issues and trends, Nigeria must prepare the regulatory landscape to support and regulate climate mitigation and adaptation strategies such as climate finance, comprising carbon taxation, carbon trading, green banking and investments, as well as robust monitoring, tracking, and verification systems. Some critical issues that should be resolved include the following:

- Review the Climate Change Act (2021):

The Nigeria Climate Change Act, as it currently stands, does not provide the NCCC Secretariat with full power and autonomy to drive climate change action in Nigeria. The NCCC still operates under the political shadow of the Federal Ministry of Environment and the Presidency.

The Act should elaborate on the functions of the NCCC Secretariat by adding more specificity to the operational framework of the Secretariat. This will grant the Secretariat the structure to advance its mission efficiently.

The Act should also be reviewed to clarify the climate change fund, including its funding sources, scope of operation, and functions, as well as its management and trustees, to promote transparency, accountability, and gain buy-in from the private sector.

The Act should be updated to establish carbon reporting regulations, including requirements and penalties for both VCMs and CCMs.

2. Support sub-national governments, including local governments, to engage in climate change action through education, advocacy, and joint venture projects (which should be driven by sub-national Ministries, Departments, and Agencies).

3. Demystify climate finance and increase public awareness of the need for and benefits of transitioning to more sustainable modes of economic development in the agricultural, transportation, and construction industries.

4. Enforce tariffs and tax exemptions on earnings from green or renewable energy investments and the importation of equipment such as solar panels, wind turbines, and other renewable energy technologies.

5. Mobilize adequate public funds for the Nigeria Climate Change Fund through the 2025 appropriation bill to demonstrate national commitment toward climate action in Nigeria.

6. Establish a centralized carbon registry to monitor, track, and verify carbon reduction projects in Nigeria.

REFERENCES

- UNFCC: Introduction to Climate Finance. https://unfccc.int/topics/introduction-to-climate-finance

- UNDP Global Climate Promise (2023). What is climate finance and why do we need more of it?

- OECD (2024): Climate Finance and the USD 100 Billion Goal.

- Nairametrics (2024): Nigeria Carbon Market Activation Plan

- UNFCC: About COP 29.

- Carbon Brief: COP29: Key outcomes agreed at the UN climate talks in Baku. https://www.carbonbrief.org/cop29-key-outcomes-agreed-at-the-un-climate-talks-in-baku/